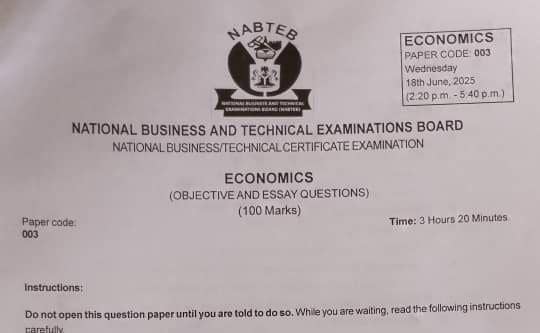

NABTEB 2025 ECONOMICS ANSWERS

NABTEB ECONOMICS

01-10: DCACCABACA

11-20: BBCADBADCC

21-30: CCABCDBCBA

31-40: BADACBABCC

41-50: DABDBCBDDA

COMPLETED

PART II: ANSWER FOUR(4) QUESTION FROM THIS PART

======================

(3a)

(i) Entrepreneurial Skill: The skill, initiative, and resourcefulness of the entrepreneur largely determine how big a firm can grow. A highly skilled entrepreneur can mobilize resources effectively and expand the business, while less skilled ones may run smaller firms. The entrepreneur’s ability to make sound decisions and take risks influences the firm’s growth potential.

(ii) Managerial Ability: The presence of competent managers enables efficient running and expansion of the firm. Poor management limits growth and keeps the firm small. Effective management improves coordination and productivity, supporting larger firm size.

(iii) Availability of Finance: Access to sufficient funds allows a firm to invest in capital, labor, and technology to increase its size. Without adequate finance, expansion is constrained. Availability of finance depends on the banking system and investor confidence.

(iv) Extent of the Market: A large and growing market provides more opportunities for sales, encouraging firms to expand. Conversely, limited demand restricts firm size. Firms tend to grow bigger in markets with increasing returns and wide customer base.

(3b)

(i) Lack of Market Size

(ii) Limited Skill or Training

(iii) Monotony and Boredom

(iv) Transport and Communication Problems

(3c)

(i) Lack of Market Size: If the market is too small, there is insufficient demand to support specialization, limiting division of labour. Specialization requires a wide market to absorb increased output. Without enough customers, firms cannot justify dividing tasks extensively.

(ii) Limited Skill or Training: Workers may lack the necessary skills or training to perform specialized tasks efficiently, restricting how much division of labour can be applied. Training costs and availability affect this. Skilled labor is essential for effective specialization.

(iii) Monotony and Boredom: Performing repetitive specialized tasks can cause worker dissatisfaction, reducing motivation and productivity, which limits the practical extent of division of labour. High turnover or absenteeism may result from boredom.

(iv) Transport and Communication Problems: Poor infrastructure hinders coordination and the smooth flow of goods and information, making specialization and division of labour less effective. Efficient transport and communication are needed to link specialized tasks across locations.

===========================

(4a)

A price system is a mechanism in economics that regulates the production and consumption of goods by determining their monetary value through prices. It coordinates decisions of consumers and producers without direct communication, mainly through the forces of supply and demand in the market.

(4b)

(i) Rationing Function:

The price system rations scarce resources by allocating goods and services to those willing and able to pay the market price. When demand exceeds supply, prices rise, which discourages some consumers from buying and thus reduces excess demand. This ensures that limited goods go to those who value them most highly, helping to prevent shortages and overconsumption.

(ii) Signalling Function:

Prices act as signals to both producers and consumers about changes in market conditions. A rise in price indicates increased demand or scarcity, prompting producers to increase supply or enter the market, while consumers may reduce demand or seek substitutes. This continuous adjustment helps allocate resources efficiently without central planning.

(iii) Incentive Function:

The price system provides incentives that influence the behaviour of producers and consumers. Higher prices motivate producers to supply more of a good or service to earn greater profits, while consumers are incentivized to economize or switch to cheaper alternatives. This dynamic helps balance supply and demand, promoting efficient resource use.

(iv) Distribution Function:

The price system determines how income and resources are distributed among individuals and factors of production. Those who own scarce resources or possess skills in high demand command higher prices and incomes, influencing the allocation of wealth in the economy. This function reflects market forces rather than equitable considerations, often leading to income disparities.

===========================

(5a)

Optimum population is the ideal number of people that a country can support with its available resources and technology to achieve the highest possible standard of living. It is the population size at which per capita income or output is maximized, meaning the population is neither too large nor too small for the country’s resources.

(5b)

(i) Changing Resources and Technology:

The quantity and quality of natural resources and technology evolve over time due to discoveries, depletion, or innovation. Because these factors keep changing, the optimum population size shifts, making it difficult to identify or maintain a stable optimum population. This continual change means planning for an optimum population is always based on estimates rather than fixed facts.

(ii) Difficulty in Measurement:

Measuring the exact optimum population requires precise data on resources, capital, technology, and productivity, which is complex and often unavailable. This complexity makes it challenging for policymakers to set clear population targets based on reliable calculations. As a result, attempts to determine optimum population often rely on assumptions that may not hold true in practice.

(iii) Uncontrollable Population Growth:

Population growth is influenced by social, cultural, economic, and political factors such as birth rates, death rates, migration, and government policies, which are difficult to control precisely. Rapid population changes can outpace the ability of governments to implement effective population control measures. Consequently, population size may grow beyond or fall short of the optimum level despite efforts to manage it.

(iv) Uneven Distribution of Resources and population are often unevenly distributed within a country; some regions may be overpopulated while others are underpopulated. Such disparities complicate resource management and economic planning at both local and national levels. This spatial imbalance means that even if the overall population is optimal, some areas may suffer from resource shortages or underutilization.

===========================

(6a)

Economic development refers to the sustained actions and policies aimed at improving the economic well-being and quality of life of a community or country, including increases in income, employment, and standards of living. Economic planning, on the other hand, is the process by which a government or authority formulates strategies and allocates resources to achieve specific economic development goals within a given period. While economic development is the broader goal, economic planning is the organized effort to achieve that goal through targeted interventions and policies.

(6b)

(i) Strategic Planning

(ii) Tactical Planning

(iii) Operational Planning

(6c)

(i) Strategic Planning:

Strategic planning sets the long-term vision and broad goals for economic development, usually spanning several years. It analyzes strengths, weaknesses, opportunities, and threats to define clear objectives and guides decision-making by prioritizing key sectors for sustainable growth. This planning provides a roadmap for coordinated actions and resource allocation to achieve shared development goals. It also helps communities focus limited resources on opportunities with the greatest potential for success and impact.

(ii) Tactical Planning:

Tactical planning breaks down strategic goals into medium-term, specific, and actionable objectives, typically covering a few years. It focuses on resource allocation, program development, and coordination among government agencies and partners to implement strategies effectively. This planning stage ensures progress by setting budgets, timelines, and performance indicators. It translates the broad vision into practical steps that align with available resources and capacities.

(iii) Operational Planning:

Operational planning involves short-term, detailed plans that specify daily or weekly activities to implement tactical plans. It manages scheduling, staffing, and resources to ensure efficient execution of projects and programs. This type of planning translates higher-level goals into concrete actions and helps address challenges promptly during implementation. It ensures that all involved parties know their responsibilities and deadlines, facilitating smooth day-to-day operations.

===========================

RELATED POST:

NABTEB Government 2025 Questions And Answers

NABTEB Chemistry 2025 Questions And Answers

(7a)

(i) Both Facilitate Fund Mobilization:

The money market and capital market both serve as channels for mobilizing funds from savers to borrowers, enabling the efficient allocation of financial resources within the economy. This function supports businesses, governments, and individuals in meeting their financing needs.

(ii) Both Are Integral Parts of the Financial System:

Both markets are essential components of the financial system, providing platforms for the buying and selling of financial instruments under regulated conditions. They help maintain economic stability by facilitating investment and liquidity.

(7b)

A stock exchange market is a formal and regulated marketplace where buyers and sellers come together to trade shares, bonds, and other securities. It provides a platform for companies to raise capital by issuing stocks to the public and for investors to buy and sell these securities in an organized and transparent environment.

=EXPLANATIONS=

(i) Capital Raising:

Stock exchanges enable companies to raise long-term capital by issuing shares or bonds to the public. This process allows businesses to finance expansion without relying solely on bank loans, spreading financial risk among many investors.

(ii) Liquidity:

The stock exchange provides liquidity to investors by allowing them to easily buy and sell securities. High liquidity also helps stabilize prices by enabling quick adjustments to market information.

(iii) Price Discovery:

Through the interaction of supply and demand, stock exchanges help determine the fair market price of securities. This price discovery mechanism reflects real-time investor sentiment and economic conditions.

(iv) Regulation and Transparency:

Stock exchanges operate under strict regulatory frameworks to ensure fair trading practices, protect investors from fraud, and maintain market integrity. Transparency requirements compel companies to disclose financial health, fostering investor confidence.

(v) Economic Growth:

By facilitating capital formation and investment, stock exchanges contribute to economic development. Access to capital markets encourages entrepreneurship and innovation, which drives long-term growth.

(vi) Investor Protection:

Regulations enforced by stock exchanges and securities commissions protect investors by ensuring that companies provide accurate information and comply with legal standards. This protection helps maintain trust in the financial system.

(vii) Market Efficiency:

Stock exchanges promote efficient allocation of resources by directing funds to the most promising and productive companies. Efficient markets also reduce the cost of capital for businesses.

(viii) Role of Intermediaries:

Brokers and dealers act as intermediaries in stock exchanges, facilitating transactions between buyers and sellers. They also provide market liquidity and help match supply with demand.

===========================

COMPLETED

Mr. Femi is an education blogger who simplifies exam updates and study tips for Nigerian students. His goal is to make learning smart, easy, and rewarding.

1 thought on “NABTEB Economics 2025 Questions And Answers”